Why Employee vs. Independent Contractor Classification Matters [INFOGRAPHIC]

Although some may overlook it, classifying someone as either an employee or a contract worker matters for both businesses owners and employees.

Businesses can face issues with the IRS for improper employee classification, and employees may be getting the short end of the employment stick if they are improperly classified in terms of both pay and benefits.

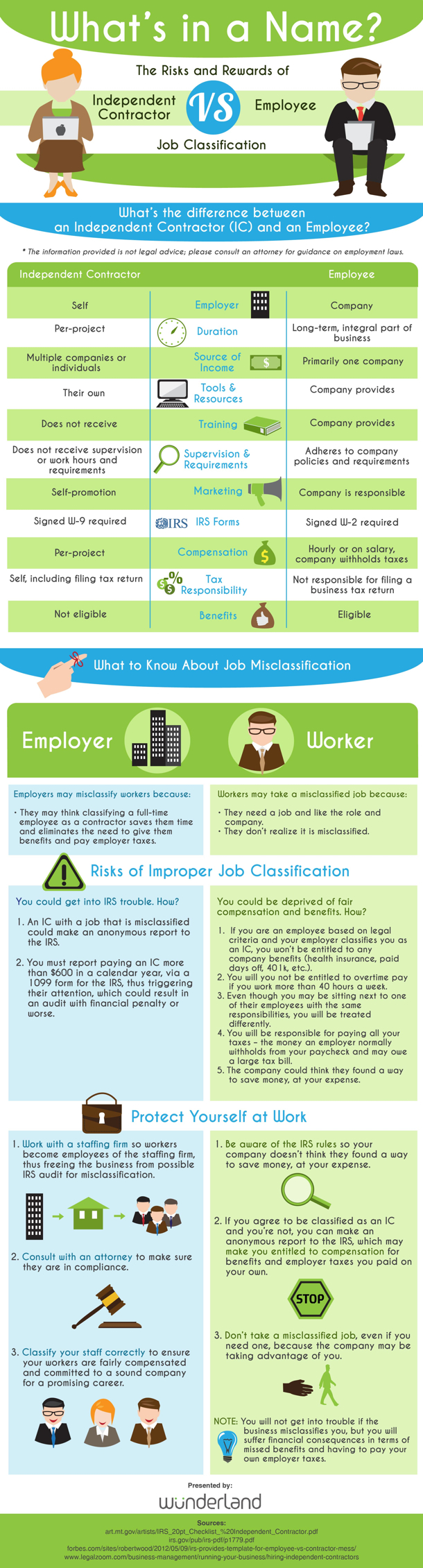

This infographic, compiled by Wunderland, a creative staffing agency, provides useful information for both business owners and job seekers about the differences between being classified as an independent contractor vs. being classified as an employee.

It also covers what you need to know about job mis-classification along with the risks of improper job classification, and how to protect yourself at work.

Here are some key points to note:

- As an employee, much of the burden of the work falls on the employer, from training to providing you a computer and other resources to assuring your taxes are being paid from your wages.

- A company can try to take advantage of an employee by improperly classifying them as an independent contractor.

- Employers can work with a staffing firm to avoid mis-classification and IRS tax audits.

Check out the full infographic below and let us know your thoughts in the comments!

What do you think? Is it easy to distinguish an employee from a contract worker in your line of work?